◆One card member can only bring in another two non-members into the store. ◆Must show card at cashier for purchase.

What is the difference between each type of membership?

Executive Membership:

●$130.00 Annual membership fee ($65 membership fee, plus $65 upgrade fee)*

●Includes a free Household Card

●Valid at all Costco locations worldwide

●Annual 2% Reward on qualified Costco purchases (terms and conditions apply)

●Additional benefits and greater savings on Costco Services

●Extra benefits on select Costco Travel products

Business Membership:

●$65.00 Annual membership fee*

●Includes a free Household Card

●Add Affiliate Cardholders for $65 each*

●Valid at all Costco locations worldwide

●Purchase for resale

●Business Members must provide Costco with the appropriate resale information

Gold Star Membership:

●$65.00 Annual membership fee*

●Includes a free Household Card

●Valid at all Costco locations worldwide

You can find more details on each type of membership and even sign up right here. Please keep in mind that the Costco double guarantee applies to all membership levels. That means we guarantee both your membership and our products with a refund†, if they don’t meet your satisfaction.

*Plus applicable sales tax.

†Limitations apply. See the membership counter or Costco.com for details.

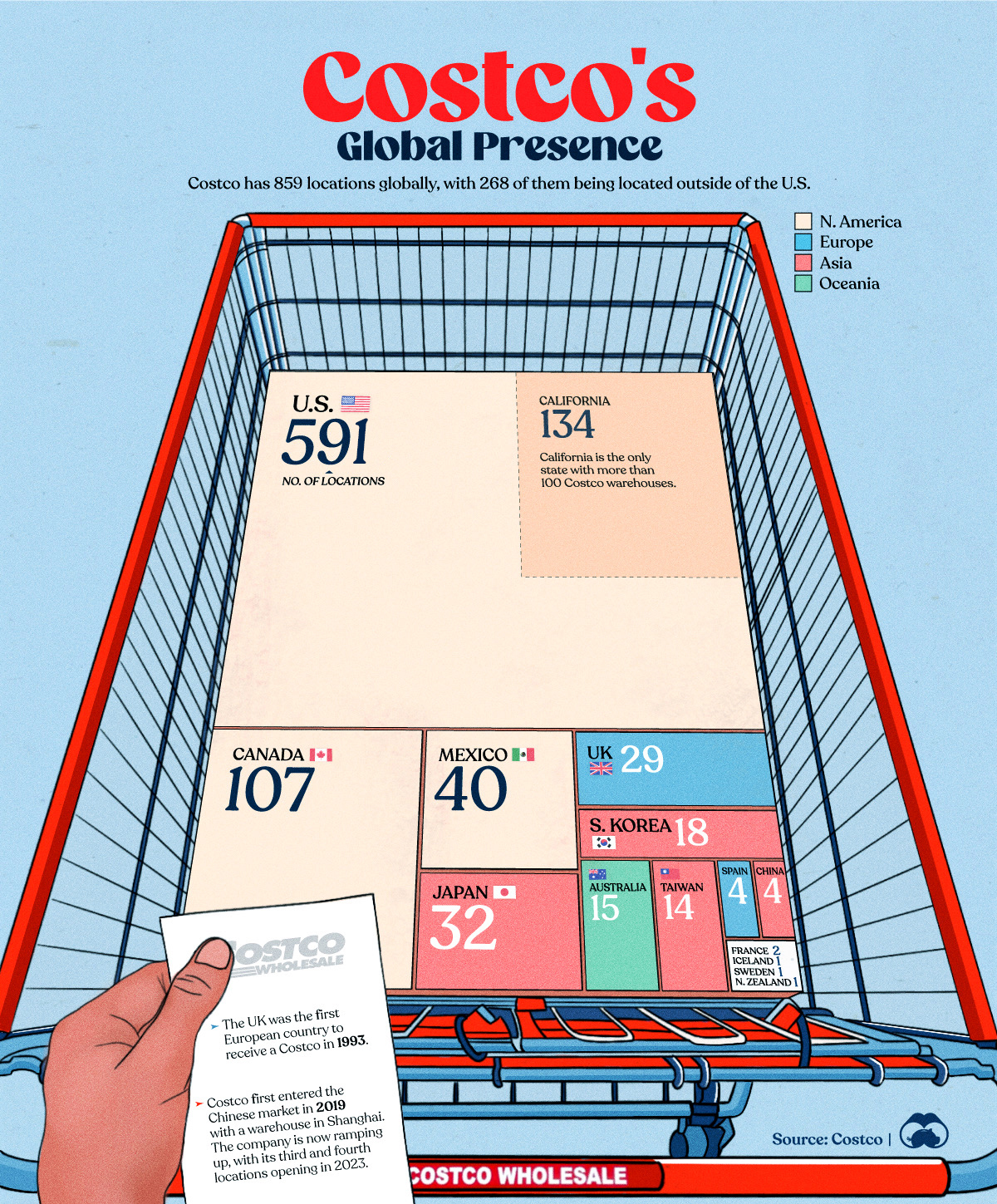

As of August 2023, Costco has 859 locations worldwide, with 591 in the U.S.A and 268 in other countries.

Visualizing the Number of Costco Stores, by Country

Number of Costco stores globally

Visualizing Costco’s Global Presence

Costco is a membership-based retail chain founded in 1983 in Seattle, Washington. Best known for its unique warehouse stores and high-quality products, Costco offers everything from electronics to groceries.

Since its founding, Costco has become a major retailer in the U.S., while also greatly expanding its international presence. As of August 2023, the company has 859 locations globally, with a split of 69% domestic (591 stores) and 31% international (268 stores).

Number of Costco Stores Worldwide

The following table lists the number of Costco stores by country, as of Aug. 17, 2023.

Country Number of locations

🇺🇸 U.S. 591

🇨🇦 Canada 107

🇲🇽 Mexico 40

🇯🇵 Japan 32

🇬🇧 UK 29

🇰🇷 Korea 18

🇦🇺 Australia 15

🇹🇼 Taiwan 14

🇪🇸 Spain 4

🇨🇳 China 4

🇫🇷 France 2

🇮🇸 Iceland 1

🇳🇿 New Zealand 1

🇸🇪 Sweden 1

Total 859

From this data we can see that Costco’s biggest non-U.S. markets are Canada, Mexico, and Japan.

In fact, Costco’s first non-U.S. location was opened near Vancouver, British Columbia in 1985. The company expanded to Mexico several years later in 1992, and then Japan in 1999.

Costco has recently turned its attention to China, opening four stores in areas around Shanghai since 2019. Reception was overwhelmingly positive—as CNBC reported, massive crowds at the grand opening of Costco’s first store forced an early closure. The company is planning to grow its Chinese presence even further, with new locations planned for Hangzhou, Shenzhen, and Nanjing.

For context, Costco is hardly the first U.S. retail chain to break into the Chinese market. Walmart first expanded to China in 1996 with a store in Shenzhen, and as of January 2023, operates 365 stores in the country.

The Sweden and New Zealand locations both opened in 2022, showing that Costco’s international expansion is still very much underway.

Number of Costco Stores by State

Focusing on the U.S., here are the number of locations in each state.

State Number of Stores

California 134

Texas 38

Washington 33

Florida 31

Illinois 23

New Jersey 21

Arizona 20

New York 19

Georgia 17

Virginia 17

Michigan 16

Colorado 16

Utah 14

Oregon 13

Minnesota 13

Ohio 13

Maryland 11

Pennsylvania 11

Wisconsin 10

North Carolina 10

Missouri 9

Connecticut 8

Nevada 8

Indiana 8

Hawaii 7

Idaho 7

Massachusetts 6

South Carolina 6

Tennessee 6

Montana 6

Puerto Rico 5

Alabama 4

Oklahoma 4

Alaska 4

Iowa 4

Kentucky 4

Louisiana 3

Nebraska 3

New Mexico 3

Kansas 3

North Dakota 2

Arkansas 1

Mississippi 1

South Dakota 1

Delaware 1

District of Columbia 1

Vermont 1

New Hampshire 1

Maine 0

Rhode Island 0

West Virginia 0

Wyoming 0

The United States currently has 50 states

America’s most populous state, California, leads the nation with 134 locations (23% of total). This is likely due to Costco’s business strategy, which relies more on membership fees and sales volume rather than high markups on products. According to analysis by Forbes, the average markup at Costco is estimated to be 11%, while at Walmart it stands at 24%.

This may explain why Maine, Rhode Island, West Virginia, and Wyoming do not have any Costco locations. Most of these states are relatively low in population density, with the exception of Rhode Island which is very small geographically.

Note: According to local news sources, Maine is set to receive its first Costco location later in 2023.

Local Adaptations

While Costco locations in the U.S. often take the form of a traditional warehouse with ample surface level parking, some stores in other countries break from that formula.

In the Santa Fe neighborhood of Mexico City, the retail space and parking of the Costco lies below ground, while the roof of the building acts as an extension to the adjacent park, featuring sports fields and a green roof.

Vancouver, Canada, is home to an urban Costco, which blends into its high density surroundings and is capped by multiple condo towers.

While the price of the company’s famous hot dog and soda combo may stay the same, the company continues to adapt to changing preferences and new locales.

Visualizing the Number of Costco Stores, by Country

Costco Jo

Be valued,

We promote

from within.

Did You Know?

Costco Wholesale is a multi-billionWhat Is Costco?

Costco is a membership warehouseThe History of Costco

The company's first location, openedOur operating philosophy has been

Costco has transformed the retail

At first, Price Club was limited

Seven years later, Jim Sinegal channel

Over the next decade, both Price Club

Today, as the company evolves, it

Commitment to quality. Costco ware-

Entrepreneurial spirit. Throughout the

Employee focus. Costco is often

Sept. 26, 2023 (GLOBE NEWSWIRE) -- Costco Wholesale Corporation (“Costco” or the “Company”) (Nasdaq: COST) today announced its operating results for the 17-week fourth quarter and the 53-week fiscal year ended September 3, 2023.

Net sales for the 17-week fourth quarter were $77.43 billion, an increase of 9.4 percent from $70.76 billion in the 16-week fourth quarter last year. Net sales for the 53-week fiscal year were $237.71 billion, an increase of 6.7 percent from $222.73 billion in the 52-week fiscal year of 2022.

Comparable sales were as follows:

| 17 Weeks | 17 Weeks | 53 Weeks | 53 Weeks | ||||

| Adjusted* | Adjusted* | ||||||

| U.S. | 0.2% | 3.1% | 3.3% | 4.2% | |||

| Canada | 1.8% | 7.4% | 1.7% | 8.1% | |||

| Other International | 5.5% | 4.4% | 2.8% | 7.6% | |||

| Total Company | 1.1% | 3.8% | 3.0% | 5.2% | |||

| E-commerce | -0.8% | -0.6% | -5.7% | -4.8% |

*Excluding the impacts from changes in gasoline prices and foreign exchange.

Net income for the 17-week fourth quarter was $2.160 billion, $4.86 per diluted share, compared to $1.868 billion, $4.20 per diluted share, in the 16-week fourth quarter last year.

Net income for the 53-week fiscal year was $6.292 billion, $14.16 per diluted share, compared to $5.844 billion, $13.14 per diluted share, in the 52-week prior year.

Costco currently operates 861 warehouses, including 591 in the United States and Puerto Rico, 107 in Canada, 40 in Mexico, 33 in Japan, 29 in the United Kingdom, 18 in Korea, 15 in Australia, 14 in Taiwan, five in China, four in Spain, two in France, and one each in Iceland, New Zealand and Sweden. Costco also operates e-commerce sites in the U.S., Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia.

A conference call to discuss these results is scheduled for 2:00 p.m. (PT) today, September 26, 2023, and will be available via a webcast on investor.costco.com (click “Events & Presentations”).

Certain statements contained in this document constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking statements are statements that address activities, events, conditions or developments that the Company expects or anticipates may occur in the future. In some cases forward-looking statements can be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. These risks and uncertainties include, but are not limited to, domestic and international economic conditions, including exchange rates, inflation or deflation, the effects of competition and regulation, uncertainties in the financial markets, consumer and small business spending patterns and debt levels, breaches of security or privacy of member or business information, conditions affecting the acquisition, development, ownership or use of real estate, capital spending, actions of vendors, rising costs associated with employees (generally including health-care costs), energy and certain commodities, geopolitical conditions (including tariffs and the Ukraine conflict), the ability to maintain effective internal control over financial reporting, regulatory and other impacts related to climate change, public-health related factors, and other risks identified from time to time in the Company’s public statements and reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and the Company does not undertake to update these statements, except as required by law. Comparable sales and comparable sales excluding impacts from changes in gasoline prices and foreign exchange are intended as supplemental information and are not a substitute for net sales presented in accordance with GAAP.

| CONTACTS: | Costco Wholesale Corporation |

| Richard Galanti, 425/313-8203 | |

| David Sherwood, 425/313-8239 | |

| Josh Dahmen, 425/313-8254 |

CO STCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(dollars in millions, except per share data)

(unaudited)

| 17 Weeks Ended | 16 Weeks Ended | 53 Weeks Ended | 52 Weeks Ended | ||||||||||||

| September 3, 2023 | August 28, 2022 | September 3, 2023 | August 28, 2022 | ||||||||||||

| REVENUE | |||||||||||||||

| Net sales | $ | 77,430 | $ | 70,764 | $ | 237,710 | $ | 222,730 | |||||||

| Membership fees | 1,509 | 1,327 | 4,580 | 4,224 | |||||||||||

| Total revenue | 78,939 | 72,091 | 242,290 | 226,954 | |||||||||||

| OPERATING EXPENSES | |||||||||||||||

| Merchandise costs | 69,219 | 63,558 | 212,586 | 199,382 | |||||||||||

| Selling, general and administrative | 6,939 | 6,036 | 21,590 | 19,779 | |||||||||||

| Operating income | 2,781 | 2,497 | 8,114 | 7,793 | |||||||||||

| OTHER INCOME (EXPENSE) | |||||||||||||||

| Interest expense | (56 | ) | (48 | ) | (160 | ) | (158 | ) | |||||||

| Interest income and other, net | 238 | 67 | 533 | 205 | |||||||||||

| INCOME BEFORE INCOME TAXES | 2,963 | 2,516 | 8,487 | 7,840 | |||||||||||

| Provision for income taxes | 803 | 638 | 2,195 | 1,925 | |||||||||||

| Net income including noncontrolling interests | 2,160 | 1,878 | 6,292 | 5,915 | |||||||||||

| Net income attributable to noncontrolling interests | — | (10 | ) | — | (71 | ) | |||||||||

| NET INCOME ATTRIBUTABLE TO COSTCO | $ | 2,160 | $ | 1,868 | $ | 6,292 | $ | 5,844 | |||||||

| NET INCOME PER COMMON SHARE ATTRIBUTABLE TO COSTCO: | |||||||||||||||

| Basic | $ | 4.87 | $ | 4.21 | $ | 14.18 | $ | 13.17 | |||||||

| Diluted | $ | 4.86 | $ | 4.20 | $ | 14.16 | $ | 13.14 | |||||||

| Shares used in calculation (000’s): | |||||||||||||||

| Basic | 443,876 | 443,839 | 443,854 | 443,651 | |||||||||||

| Diluted | 444,445 | 444,655 | 444,452 | 444,757 | |||||||||||

CO STCO WHOLESALE CORPORATION

CONSOLIDATED BALANCE SHEETS

(amounts in millions, except par value and share data)

(unaudited)

Subject to Reclassification

| September 3, 2023 | August 28, 2022 | ||||||||

| ASSETS | |||||||||

| CURRENT ASSETS | |||||||||

| Cash and cash equivalents | $ | 13,700 | $ | 10,203 | |||||

| Short-term investments | 1,534 | 846 | |||||||

| Receivables, net | 2,285 | 2,241 | |||||||

| Merchandise inventories | 16,651 | 17,907 | |||||||

| Other current assets | 1,709 | 1,499 | |||||||

| Total current assets | 35,879 | 32,696 | |||||||

| OTHER ASSETS | |||||||||

| Property and equipment, net | 26,684 | 24,646 | |||||||

| Operating lease right-of-use assets | 2,713 | 2,774 | |||||||

| Other long-term assets | 3,718 | 4,050 | |||||||

| TOTAL ASSETS | $ | 68,994 | $ | 64,166 | |||||

| LIABILITIES AND EQUITY | |||||||||

| CURRENT LIABILITIES | |||||||||

| Accounts payable | $ | 17,483 | $ | 17,848 | |||||

| Accrued salaries and benefits | 4,278 | 4,381 | |||||||

| Accrued member rewards | 2,150 | 1,911 | |||||||

| Deferred membership fees | 2,337 | 2,174 | |||||||

| Current portion of long-term debt | 1,081 | 73 | |||||||

| Other current liabilities | 6,254 | 5,611 | |||||||

| Total current liabilities | 33,583 | 31,998 | |||||||

| OTHER LIABILITIES | |||||||||

| Long-term debt, excluding current portion | 5,377 | 6,484 | |||||||

| Long-term operating lease liabilities | 2,426 | 2,482 | |||||||

| Other long-term liabilities | 2,550 | 2,555 | |||||||

| TOTAL LIABILITIES | 43,936 | 43,519 | |||||||

| COMMITMENTS AND CONTINGENCIES | |||||||||

| EQUITY | |||||||||

| Preferred stock $0.005 par value; 100,000,000 shares authorized; no shares issued and outstanding | — | — | |||||||

| Common stock $0.005 par value; 900,000,000 shares authorized; 442,793,000 and 442,664,000 shares issued and outstanding | 2 | 2 | |||||||

| Additional paid-in capital | 7,340 | 6,884 | |||||||

| Accumulated other comprehensive loss | (1,805 | ) | (1,829 | ) | |||||

| Retained earnings | 19,521 | 15,585 | |||||||

| Total Costco stockholders’ equity | 25,058 | 20,642 | |||||||

| Noncontrolling interests | — | 5 | |||||||

| TOTAL EQUITY | 25,058 | 20,647 | |||||||

| TOTAL LIABILITIES AND EQUITY | $ | 68,994 | $ | 64,166 | |||||

CO STCO WHOLESALE CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(amounts in millions)

(unaudited)

Subject to Reclassification

| 53 Weeks Ended | 52 Weeks Ended | ||||||

| September 3, 2023 | August 28, 2022 | ||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||

| Net income including noncontrolling interests | $ | 6,292 | $ | 5,915 | |||

| Adjustments to reconcile net income including noncontrolling interests to net cash provided by operating activities: | |||||||

| Depreciation and amortization | 2,077 | 1,900 | |||||

| Non-cash lease expense | 412 | 377 | |||||

| Stock-based compensation | 774 | 724 | |||||

| Other non-cash operating activities, net | 495 | 39 | |||||

| Changes in working capital | 1,018 | (1,563 | ) | ||||

| Net cash provided by operating activities | 11,068 | 7,392 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||

| Purchases of short-term investments | (1,622 | ) | (1,121 | ) | |||

| Maturities and sales of short-term investments | 937 | 1,145 | |||||

| Additions to property and equipment | (4,323 | ) | (3,891 | ) | |||

| Other investing activities, net | 36 | (48 | ) | ||||

| Net cash used in investing activities | (4,972 | ) | (3,915 | ) | |||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||

| Repayments of short-term borrowings | (935 | ) | (6 | ) | |||

| Proceeds from short-term borrowings | 917 | 53 | |||||

| Repayments of long-term debt | (75 | ) | (800 | ) | |||

| Tax withholdings on stock-based awards | (303 | ) | (363 | ) | |||

| Repurchases of common stock | (676 | ) | (439 | ) | |||

| Cash dividend payments | (1,251 | ) | (1,498 | ) | |||

| Financing lease payments | (291 | ) | (176 | ) | |||

| Dividend to noncontrolling interest | — | (208 | ) | ||||

| Acquisition of noncontrolling interest | — | (842 | ) | ||||

| Other financing activities, net | — | (4 | ) | ||||

| Net cash used in financing activities | (2,614 | ) | (4,283 | ) | |||

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | 15 | (249 | ) | ||||

| Net change in cash and cash equivalents | 3,497 | (1,055 | ) | ||||

| CASH AND CASH EQUIVALENTS BEGINNING OF YEAR | 10,203 | 11,258 | |||||

| CASH AND CASH EQUIVALENTS END OF YEAR | $ | 13,700 | $ | 10,203 | |||

No comments:

Post a Comment