How to Invest in US Savings Bonds

Investing in US savings bonds is a simple and easy way to put your money to work and begin saving money. This guide to investing in US savings bonds features in-depth information on how savings bonds work, the Series EE savings bonds, Series I savings bonds, and other products issued by the United States Treasury Department. It will explain tax benefits, where to purchase bonds, how to find out the interest rate you are earning on your money, and much more.

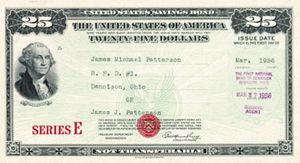

01 The History of US Savings Bonds

02

Should Savings Bonds Be In Your Portfolio?

03 Guide to Investing in Series I Savings Bonds

04 Guide to Investing in Series EE Savings Bonds

05

Series HH Savings Bonds

06

What Are the Savings Bonds Tax Traps I Should Avoid?

Think Carefully About the Way You Title Your U.S. Savings Bonds

:brightness(10):contrast(5):no_upscale()/TheWayYouTitleYourUnitedStatesSavingsBondsCanHaveTaxConsequences-56ae67705f9b58b7d010097f.jpg)

How you title your U.S. savings bonds can have major tax and inheritance implications for you and your family, regardless of whether you choose to own Series I savings bonds, Series EE savings bonds, or both. In a broad sense, there are only three ways you can title your savings bond ownership or, really, any new bond investment you may make.

Holding Title to U.S. Savings Bonds as an Individual

Titling a savings bond under the name of a single owner is the easiest.

It means legally speaking, there is only a single owner of the bonds. When this owner dies, the bond becomes part of his or her estate. If there is no valid will and testament, and you have not selected a beneficiary (we'll discuss this in a moment) the savings bonds may be subject to the laws of Intestate Succession via probate. These inheritance laws vary from state to state and take time, money, and effort for your heirs. For example, in some states, your spouse will receive half of the property while your parents will receive the other half. In certain states, your spouse will receive up to a fixed amount (e.g. $20,000) with everything thereafter divided equally between your spouse and your children.

One way to avoid probate and intestate succession while still having single ownership is to title the savings bonds in the name of a living trust. That way, when you die, the trustee(s) can continue to transact business, your heirs immediately receiving the benefit of the property in a way spelled out within the trust instrument.

To learn more about this topic, read How to Setup a Trust Fund.

Another way to avoid probate when using a single ownership title on a U.S. savings bond is to explicitly name a beneficiary with the U.S. Treasury Department through TreasuryDirect. Upon the death of the original, titled savings bond holder, the beneficiary establishes his or her own TreasuryDirect account and follows a straightforward process to have the bonds transferred to it.

Even if the original owner left a will, it doesn't matter because the beneficiary designation on the savings bonds override it.

There is a major tax advantage to using the beneficiary designation in conjunction with a single owner title. You already learned from the Investing in Savings Bonds guide that you can either pay taxes on the interest that is added to your bonds each year, or wait until you cash the savings bonds, paying all of the taxes at once. Most people choose the latter. If the owners of the savings bonds dies and passes them to the beneficiary, then the beneficiary can elect to have all of the interest earned on the savings bonds included on the last Federal tax filing of the original, now deceased owner of the bond, making it a liability of his estate. In effect, the savings bonds are being passed tax-free with the estate itself picking up the tab. This is far preferable to receiving cash, where this is not an option.Holding Title to U.S. Savings Bonds as a Co-Owner

Co-ownership between spouses, family members, parents and children, or other parties, means that two people hold title to the savings bonds together. Either title holder can cash the savings bonds without the permission or knowledge of the other party, triggering a taxable event for both, so only do this if you have total, absolute faith in the other person.

Co-ownership title of a savings bond means that if one party dies, the other co-owner becomes the new, sole owner. The bonds pass directly to the surviving, titled owner while avoiding probate.

Learn More About Investing in U.S. Savings Bonds

Although they are frequently written off as not worthy of serious consideration for an investor's portfolio, perhaps due to an association with old-fashioned gifts received by children at birthday parties and Christmas from distant relatives, a substantial percentage of American families should keep savings bond investments in the back of their minds as a potentially wise place to employ funds. This is especially true when interest rates are reasonably attractive and equity prices are rich. Savings bonds provide absolute safety of principle backed by the full faith and credit of the United States Government.

They offer meaningful protection against interest rate and duration risk. If you select the Series I savings bonds, they can even keep pace, to some degree, with inflation.

The biggest drawback of investing in savings bonds is the annual purchase limits Congress puts on them. For the past few decades, it has almost been as if Wall Street has influenced politicians to take away many of the advantages of savings bonds, making them less attractive compared to other, traditional financial securities that generate profits for the firms that back them. Frankly, I'd like to see the savings bond limit raised to something like $50,000 per individual, per year compared to the rather pathetic limit that is currently available on issues such as the Series I bonds.

No comments:

Post a Comment