Have you heard of the Hawaiian therapist who cured an entire ward of criminally insane patients, without ever meeting any of them or spending a moment in the same room? It’s not a joke. The therapist was Dr. Ihaleakala Hew Len. He reviewed each of the patients’ files, and then he healed them by healing himself. The amazing results seem like a miracle, but then miracles do happen when you use Ho’oponopono, or Dr. Len’s updated version called Self I-Dentity Through Ho’oponopono (SITH). I had the pleasure of attending one of his lectures a few years ago and started practicing Ho’oponopono immediately. The results are often astounding. Do you need a miracle?

What you might wish to understand is how this can possibly work. How can you heal yourself and have it heal others? How can you even heal yourself?

Why would it affect anything “out there”? The secret is there is no such thing as “out there” – everything happens to you in your mind. Everything you see, everything you hear, every person you meet, you experience in your mind. You only think it’s “out there” and you think that absolves you of responsibility. In fact it’s quite the opposite: you are responsible for everything you think, and everything that comes to your attention. If you watch the news, everything you hear on the news is your responsibility. That sounds harsh, but it means that you are also able to clear it, clean it, and through forgiveness change it.

There are four simple steps to this method, and the order is not that important. Repentance, Forgiveness, Gratitude and Love2 are the only forces at work – but these forces have amazing power.

The best part of the updated version of Ho’oponopono is you can do it yourself, you don’t need anyone else to be there, you don’t need anyone to hear you. You can “say” the words in your head. The power is in the feeling and in the willingness of the Universe to forgive and love.

This realization can be painful, and you will likely resist accepting responsibility for the “out there” kind of problems until you start to practice this method on your more obvious “in here” problems and see results.

So choose something that you already know you’ve caused for yourself? Over-weight? Addicted to nicotine, alcohol or some other substance? Do you have anger issues? Health problems? Start there and say you’re sorry. That’s the whole step: I’M SORRY.

Although I think it is more powerful if you say it more clearly: “I realize that I am responsible for the (issue) in my life and I feel terrible remorse that something in my consciousness has caused this.”

Don’t worry about who you’re asking. Just ask! PLEASE FORGIVE ME. Say it over and over. Mean it. Remember your remorse from step 1 as you ask to be forgiven.

That’s it. The whole practice in a nutshell. Simple and amazingly effective.

Generally, I will teach you a way to get rid of sub conscious memory. Your mind will know the way all by itself, as you will progress.

The method basically uses a kind of therapy which helps remove all kinds of negative thoughts from your mind. This can include thoughts which can hold you back from your success, slowing or stopping you down completely. These are mostly the thoughts which make you believe that a particular thing is not achievable, thus you will always find yourself not being able to achieve what you want.

You then get to the zero stage, the stage which basically is the beginning. The stage where you will believe in anything you want to believe, and you’ll feel renewed with this new kind of energy, the spirit to reach out and touch your dreams with your bare hands. All of this is going to happen, just with the help of this single course.

That is when you know you’re spiritually clean and healed, ready to go on your way to success.

A strong will is the only requirement for the process to work.

What you basically have set the goal in the your ho'oponopono is to cleanse your mind, and then heal it. The cleansing part includes eliminating all thoughts which might be bad for you, and keeping and enhancing all of them which will bring you closer to success. The healing part is when the course will help you implant positivity in your mind, which will just give you a boost and encourage you to achieve everything you want to.

The only requirement is that you are

eager to learn.

It is important to know that if you ever face failure in life, it really isn’t the end of the world. There are hundreds and thousands of methods out there to get you through, several people who can guide you through your difficult phases. But to completely leave failure behind, and face success throughout, Ho’oponopono is a proven and certified way to get on your way!

I am sorry,

please forgive me,

thank you,

I love you,

Who is in charge of you?

(Click here * )

The Evidence (Click & Read here)

"Hoʻoponopono" is defined in the Hawaiian Dictionary as:

(a) "To put to rights; to put in order or shape, correct, revise, adjust, amend, regulate, arrange, rectify, tidy up make orderly or neat, administer, superintend, supervise, manage, edit, work carefully or neatly; to make ready, as canoemen preparing to catch a wave."

(b) "Mental cleansing: family conferences in which relationships were set right (hoʻoponopono) through prayer, discussion, confession, repentance, and mutual restitution and forgiveness."

Literally, hoʻo is a particle used to make an actualizing verb from the following noun, as would "to" before a noun in English. Here, it creates a verb from the noun pono, which is defined as: "...goodness, uprightness, morality, moral qualities, correct or proper procedure, excellence, well-being, prosperity, welfare, benefit, true condition or nature, duty; moral, fitting, proper, righteous, right, upright, just, virtuous, fair, beneficial, successful, in perfect order, accurate, correct, eased, relieved; should, ought, must, necessary."

Ponopono is defined as "to put to rights; to put in order or shape, correct, revise, adjust, amend, regulate, arrange, rectify, tidy up, make orderly or neat."

Beyond Traditional Means: Ho'oponopono

Click Here http://ho-oponopono-explained.blogspot.com/search?updated-max=2015-01-07T11:19:00-08:00&max-results=22&reverse-paginate=true&start=22&by-date=false

What you might wish to understand is how this can possibly work. How can you heal yourself and have it heal others? How can you even heal yourself?

Why would it affect anything “out there”? The secret is there is no such thing as “out there” – everything happens to you in your mind. Everything you see, everything you hear, every person you meet, you experience in your mind. You only think it’s “out there” and you think that absolves you of responsibility. In fact it’s quite the opposite: you are responsible for everything you think, and everything that comes to your attention. If you watch the news, everything you hear on the news is your responsibility. That sounds harsh, but it means that you are also able to clear it, clean it, and through forgiveness change it.

There are four simple steps to this method, and the order is not that important. Repentance, Forgiveness, Gratitude and Love2 are the only forces at work – but these forces have amazing power.

The best part of the updated version of Ho’oponopono is you can do it yourself, you don’t need anyone else to be there, you don’t need anyone to hear you. You can “say” the words in your head. The power is in the feeling and in the willingness of the Universe to forgive and love.

Step 1: Repentance – I’M SORRY

As I mention above, you are responsible for everything in your mind, even if it seems to be “out there.” Once you realize that, it’s very natural to feel sorry. I know I sure do. If I hear of a tornado, I am so full of remorse that something in my consciousness has created that idea. I’m so very sorry that someone I know has a broken bone that I realize I have caused.This realization can be painful, and you will likely resist accepting responsibility for the “out there” kind of problems until you start to practice this method on your more obvious “in here” problems and see results.

So choose something that you already know you’ve caused for yourself? Over-weight? Addicted to nicotine, alcohol or some other substance? Do you have anger issues? Health problems? Start there and say you’re sorry. That’s the whole step: I’M SORRY.

Although I think it is more powerful if you say it more clearly: “I realize that I am responsible for the (issue) in my life and I feel terrible remorse that something in my consciousness has caused this.”

Step 2: Ask Forgiveness – PLEASE FORGIVE ME

Don’t worry about who you’re asking. Just ask! PLEASE FORGIVE ME. Say it over and over. Mean it. Remember your remorse from step 1 as you ask to be forgiven.

Step 3: Gratitude – THANK YOU

Say “THANK YOU” – again it doesn’t really matter who or what you’re thanking. Thank your body for all it does for you. Thank yourself for being the best you can be. Thank God. Thank the Universe. Thank whatever it was that just forgave you. Just keep saying THANK YOU.Step 4: Love – I LOVE YOU (Love transforms you)

This can also be step 1. Say I LOVE YOU. Say it to your body, say it to God. Say I LOVE YOU to the air you breathe, to the house that shelters you. Say I LOVE YOU to your challenges. Say it over and over. Mean it. Feel it. There is nothing as powerful as Love. Divine Love Transforms You.That’s it. The whole practice in a nutshell. Simple and amazingly effective.

Generally, I will teach you a way to get rid of sub conscious memory. Your mind will know the way all by itself, as you will progress.

The method basically uses a kind of therapy which helps remove all kinds of negative thoughts from your mind. This can include thoughts which can hold you back from your success, slowing or stopping you down completely. These are mostly the thoughts which make you believe that a particular thing is not achievable, thus you will always find yourself not being able to achieve what you want.

You then get to the zero stage, the stage which basically is the beginning. The stage where you will believe in anything you want to believe, and you’ll feel renewed with this new kind of energy, the spirit to reach out and touch your dreams with your bare hands. All of this is going to happen, just with the help of this single course.

That is when you know you’re spiritually clean and healed, ready to go on your way to success.

A strong will is the only requirement for the process to work.

What you basically have set the goal in the your ho'oponopono is to cleanse your mind, and then heal it. The cleansing part includes eliminating all thoughts which might be bad for you, and keeping and enhancing all of them which will bring you closer to success. The healing part is when the course will help you implant positivity in your mind, which will just give you a boost and encourage you to achieve everything you want to.

Advantages of

Ho’oponopono Course:

- Helps boost your mental skills, which includes the ability to solve any and every problem mentally. Your brain will be able to work faster and more efficiently on its own, and you will start to rely lesser on the others, and more on yourself.

- It will help improve your concentration, so you can really focus on everything you desire. Focusing is the key to success, because that way you know exactly what you want. If you concentrate on the things you want, you’ll have a clearer image of the things you are required to do to be able to reach your goals.

- Teaches your powerful techniques to relax yourself, so that the next time you find yourself facing any difficult or if you find yourself getting hyper, you’ll always know how to calm yourself down and motivate yourself. In short, you’ll never be losing hope again!

- Helps you realize that what you deserve is much more than what you already have. It makes you realize that in order to get to your ambitions, you’re going to need to struggle. But the best part is that this particular method will help make the struggle look all too appealing and worthy of the gift we are going to have at the end.

- Last but not the least Ho’oponopono has helped change hundreds of lives, helped hundreds of people through their problems. You can be like them too.

Disadvantages of

Ho’oponopono Course:

- The requirement to put in the effort and the struggle is always there. Your goals won’t just walk up to you and embrace you; you’re going to have to work harder than you ever have to achieve something. And without the will power to do so, this product will be little more than waste.

The only requirement is that you are

eager to learn.

It is important to know that if you ever face failure in life, it really isn’t the end of the world. There are hundreds and thousands of methods out there to get you through, several people who can guide you through your difficult phases. But to completely leave failure behind, and face success throughout, Ho’oponopono is a proven and certified way to get on your way!

I am sorry,

please forgive me,

thank you,

I love you,

Who is in charge of you?

(Click here * )

The Evidence (Click & Read here)

"Hoʻoponopono" is defined in the Hawaiian Dictionary as:

(a) "To put to rights; to put in order or shape, correct, revise, adjust, amend, regulate, arrange, rectify, tidy up make orderly or neat, administer, superintend, supervise, manage, edit, work carefully or neatly; to make ready, as canoemen preparing to catch a wave."

(b) "Mental cleansing: family conferences in which relationships were set right (hoʻoponopono) through prayer, discussion, confession, repentance, and mutual restitution and forgiveness."

Literally, hoʻo is a particle used to make an actualizing verb from the following noun, as would "to" before a noun in English. Here, it creates a verb from the noun pono, which is defined as: "...goodness, uprightness, morality, moral qualities, correct or proper procedure, excellence, well-being, prosperity, welfare, benefit, true condition or nature, duty; moral, fitting, proper, righteous, right, upright, just, virtuous, fair, beneficial, successful, in perfect order, accurate, correct, eased, relieved; should, ought, must, necessary."

Ponopono is defined as "to put to rights; to put in order or shape, correct, revise, adjust, amend, regulate, arrange, rectify, tidy up, make orderly or neat."

Beyond Traditional Means: Ho'oponopono

New York Times contributor Deborah King interviews Morrnah Simeona & Dr. Ihaleakala Hew Len about their Ho'oponopono philosophy and work:

"We can appeal to Divinity who knows our personal blueprint, for healing of all thoughts and memories that are holding us back at this time," softly shares Morrnah Simeona. "It is a matter of going beyond traditional means of accessing knowledge about ourselves."

The process that Morrnah refers to is based on the ancient Hawaiian method of stress reduction (release) and problem solving called Ho'oponopono. The word Ho'oponopono means to make right, to rectify an error. Morrnah is a native Hawaiian Kahuna Lapa'au. Kahuna means "keeper of the secret" and Lapa'au means "a specialist in healing." She was chosen to be a kahuna while still a small child and received her gift of healing at the age of three. She is the daughter of a member of the court of Queen Liliuokalani, the last sovereign of the Hawaiian Islands. The process that is now brought forth is a modernization of an ancient spiritual cleansing ritual. It has proven so effective that she has been invited to teach this method at the United Nations, the World Health Organization and at institutions of healing throughout the world.

How does Ho'oponopono work? Morrnah explains, "We are the sum total of our experiences, which is to say that we are burdened by our pasts. When we experience stress or fear in our lives, if we would look carefully, we would find that the cause is actually a memory. It is the emotions which are tied to these memories which affect us now. The subconscious associates an action or person in the present with something that happened in the past. When this occurs, emotions are activated and stress is produced."

"We can appeal to Divinity who knows our personal blueprint, for healing of all thoughts and memories that are holding us back at this time," softly shares Morrnah Simeona. "It is a matter of going beyond traditional means of accessing knowledge about ourselves."

The process that Morrnah refers to is based on the ancient Hawaiian method of stress reduction (release) and problem solving called Ho'oponopono. The word Ho'oponopono means to make right, to rectify an error. Morrnah is a native Hawaiian Kahuna Lapa'au. Kahuna means "keeper of the secret" and Lapa'au means "a specialist in healing." She was chosen to be a kahuna while still a small child and received her gift of healing at the age of three. She is the daughter of a member of the court of Queen Liliuokalani, the last sovereign of the Hawaiian Islands. The process that is now brought forth is a modernization of an ancient spiritual cleansing ritual. It has proven so effective that she has been invited to teach this method at the United Nations, the World Health Organization and at institutions of healing throughout the world.

How does Ho'oponopono work? Morrnah explains, "We are the sum total of our experiences, which is to say that we are burdened by our pasts. When we experience stress or fear in our lives, if we would look carefully, we would find that the cause is actually a memory. It is the emotions which are tied to these memories which affect us now. The subconscious associates an action or person in the present with something that happened in the past. When this occurs, emotions are activated and stress is produced."

Click Here http://ho-oponopono-explained.blogspot.com/search?updated-max=2015-01-07T11:19:00-08:00&max-results=22&reverse-paginate=true&start=22&by-date=false

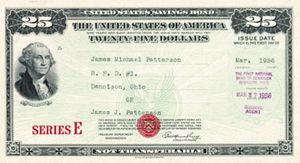

:brightness(10):contrast(5):no_upscale()/TheWayYouTitleYourUnitedStatesSavingsBondsCanHaveTaxConsequences-56ae67705f9b58b7d010097f.jpg)

:brightness(10):contrast(5):no_upscale()/sb10062269l-002-56a0921d5f9b58eba4b1a7de.jpg)

:brightness(10):contrast(5):no_upscale()/HowtoCalculateTotalReturnandCompoundAnnualGrowthRate-56fb8a3c3df78c7841a796c6.jpg)

:brightness(10):contrast(5):no_upscale()/Advisor-697534409-5add8377119fa80036f9dfbe.jpg)

:brightness(10):contrast(5):no_upscale()/Love-and-Money-56a0935f5f9b58eba4b1ae7f.jpg)

:brightness(10):contrast(5):no_upscale()/three-types-of-opportunity-cost-56a090e55f9b58eba4b19e0e.jpg)

:brightness(10):contrast(5):no_upscale()/GettyImages-57358760-5af1b174eb97de0036c7e76a.jpg)